Take control of your credit with $tand By Me

January 14, 2015

By Ashley Michini, $tand By Me Financial Coach

By Ashley Michini, $tand By Me Financial Coach

It’s never too late to take control of your financial situation. Money can be stressful, but you have the power to take small steps that will make a big difference when it comes to your day-to-day finances. Here’s a tip for building a solid personal finance foundation: take good care of your credit score.

Good credit = lower interest rates. If you ever plan to buy a house, get a car loan or apply for insurance, having bad credit score can literally cost you.

Picture two people applying for a 30-year mortgage on a $200,000 home in Delaware. Person 1 has a credit score of 760-850. They get an interest rate of 3.294% and pay an estimated $875 per month, totaling $115,090 in interest paid. Person 2 has a credit score of 620-639. Their interest rate for the same mortgage is 4.875%. Person 2 will pay $1,048 per month on their home, paying $181,030 in total interest over the course of the loan. Person 2 paid $65,940 more for their home than Person 1 due to their lower credit score. This money could have otherwise been used to buy a car, pay for children’s education, save for retirement, etc.

A good credit score also gives you bargaining power. You can ask for a lower interest rate on your credit card or refinance your home, saving you money in the long-run.

Ways to keep your credit score high:

- Make credit card payments on time, and if possible, pay off the whole balance each month.

- Spend no more than 20%-30% of your credit limit on credit cards each month.

- On a $5,000 limit, that’s about $1,000-$1,500 per month—if you anticipate exceeding that, one option is to make multiple payments in a month to compensate. You could also ask for an increase in your credit limit.

- If you have any loans, be sure to pay at least the minimum payments on time, each month.

- If you are unable to make the payment, alert the lender as soon as possible, often they have options for you. Ignoring it will make it worse.

- Don’t borrow more than you can pay back. This may cause you to make late payments which will affect your score negatively.

- Check your credit report annually for incorrect information.

- Pay off any and all fines you accrue, everything from a parking ticket to a library fine is “fair game” to be placed into collections on your credit report.

Credit is a balancing act—you have to use credit in order to build it. It’s a misconception that having no credit is better than opening a line of credit. If you never open a credit card, or take out a loan, you will have no credit history which will limit your ability to apply for a mortgage, or finance big-ticket items in the future.

Each person is entitled to one free credit report from each of the 3 credit bureaus (Experian, TransUnion, and Equifax) per year. Visit http://www.annualcreditreport.com to view yours. If you suspect there is incorrect information on your Credit Report, you have the right to dispute it with the bureaus by virtue of the Fair Credit Reporting Act.

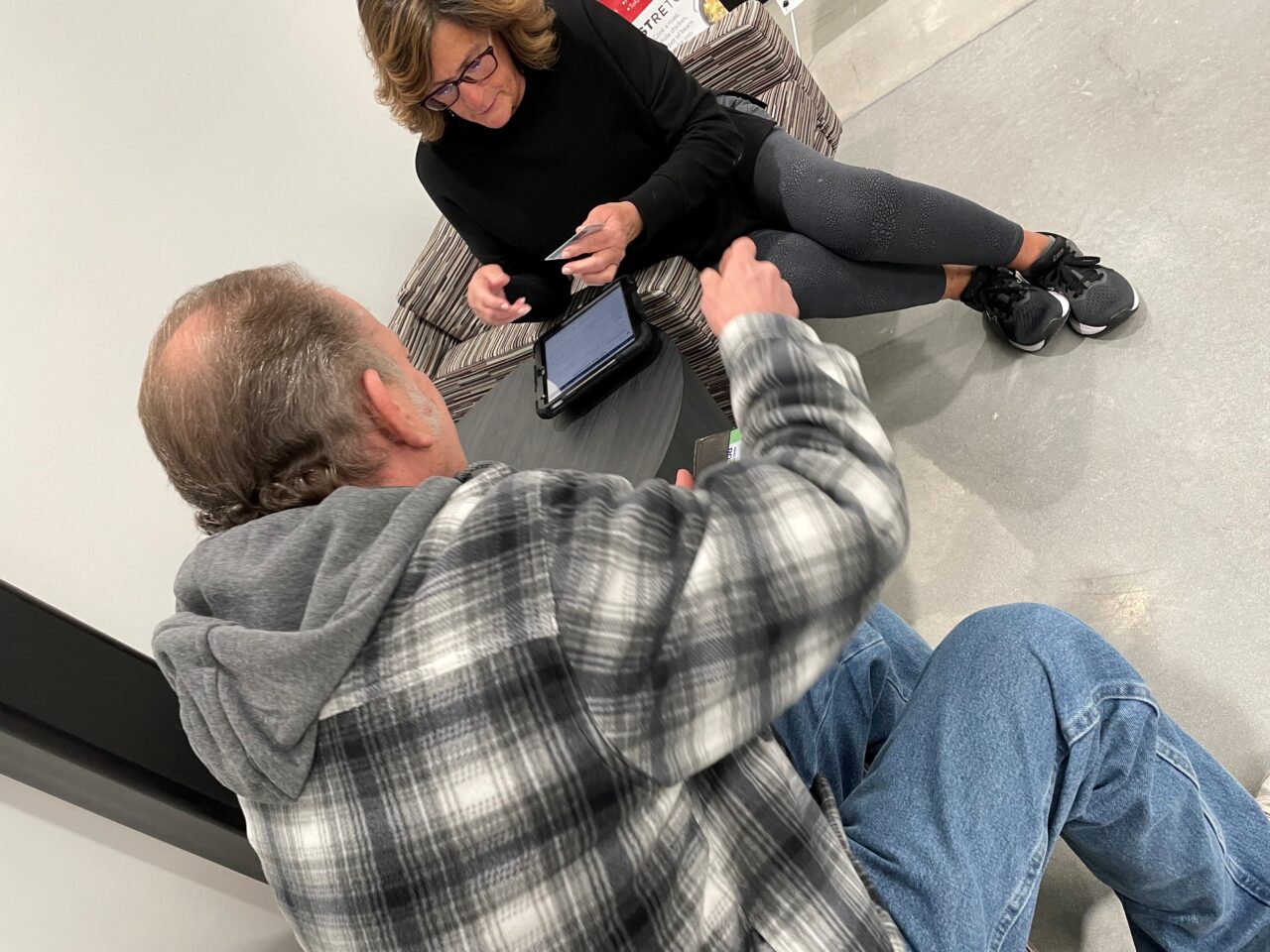

Have questions about your credit report? Don’t let it make you feel overwhelmed. As a $tand By Me Financial Coach, I can work with you to identify strategies to help you boost your credit score, provide resources for you to dispute incorrect information on your credit report, or get you connected to secured financial products to build credit safely. To set up an appointment, contact amichini@fbd.org or 302-292-1305 ex. 206.

For more info:

FTC: Building a Better Credit Report http://www.consumer.ftc.gov/articles/pdf-0032-building-a-better-credit-report.pdf

My FICO Mortgage Rate Calculator http://www.myfico.com/myfico/creditcentral/loanrates.aspx.

MoneyWi$e: Good Credit http://www.consumer-action.org/downloads/english/2013_GoodCredit_EN.pdf