Financial Tips for the New Year

January 10, 2017

By Allison Russell, $tand By Me Financial Coach

Now that we’re at the beginning of 2017, it’s a good time to set some financial goals and get started sooner rather than later. Here a few tips to help manage your finances and save more of your money.

Set SMART goals.

SMART goals are Specific, Measurable, Attainable, Realistic and Time-related. You can set a goal to be wealthy and retire but without defining what this means and how it will be achieved and if it is even realistic; it’s not likely you will reach your goal. Setting a more defined goal, like saving $1000 towards a down payment on a car in ten months by putting aside $50 per pay is an example of a SMART goal.

Track your expenses.

Keep track of your expenses each week for a month to account for every dollar (and cent) spent. There are online tools and phone apps like balancetrack.org, wally.me and mint.com that can be used to track expenses. Many banks offer expense trackers with their accounts that allow customers to monitor and classify their expenses to stay on top of their spending.

People are often surprised when they see exactly where their money is going. Habits like the morning coffee and donut, the fast food lunches and dinners, the weekends at the movie theater, etc., all add up. You don’t necessarily have to stop everything you do, but just cutting out one or two grande mocha frappuccinos per week can have an impact. Then the key is to actually save the money that’s not being spent in order to realize your financial goals.

Establish a budget.

Once you determine your regular monthly expenses, you can then compare them to your monthly income and insure you are breaking even each month. There may be occasions where you find you are overspending, but you can then make any needed adjustments and get yourself back on track. There may also be those times when you’re able to make a purchase at a discount or spend less on a bill than expected. These are great savings opportunities or may allow you to pay an additional amount on a debt owed.

Your budget will serve as your foundation to meet your obligations in a timely fashion and allow you to build your savings. There are sample budgets online at websites like powerpay.org that can help with setting up a budget.

Build an emergency fund.

Besides saving for a particular goal like a house or a car or a vacation, you should also establish an emergency fund. If you need new tires on your vehicle or have to have repairs done in your home, or encounter an unexpected medical expense, it makes sense to have a separate savings available to be accessed if needed so you don’t have to tap into the funds you’ve set aside for a particular goal. It is recommended that you have an amount equal to three to six months expenses set aside in an emergency fund. This would be of great assistance especially in the case of an extended job loss. This may be daunting initially but you can at least work towards saving $1000 to start and then continue to add to the fund.

Carefully consider where you save.

Whatever your savings goal you should look into the savings vehicles that are available and choose the best terms. You may be familiar with a particular institution, but is there another place that offers a higher rate of return or charges lower fees? While some companies may offer decent rates on savings accounts or money markets, they may not be as competitive on certificates of deposits where you may be willing to leave your money for a longer time frame and receive a higher rate of return. It’s worth it to look at banks vs. credit unions and brick and mortar companies vs. on-line institutions. By visiting websites like bankrate.com you can compare financial institutions nationwide.

Set up automatic savings.

While most of us have certain financial goals and have the best of intentions when it comes to saving, many of us find it difficult to do it on a consistent basis. To make saving easier, look into setting up an automatic savings plan. Many financial institutions allow you to set up a savings plan where you can regularly transfer money from your checking account into a savings account at a fixed interval like every month or every 2 weeks. Also, some employers can establish a direct deposit into a savings account every pay period at the employee’s request. This insures that you will save on a regular basis. Often when the amount is moved directly into savings before it is even received; many people get used to it and don’t even miss it.

Keep your eyes on the prize.

Once you set your goal and establish your budget to save a specific amount, stay focused and periodically check your progress. You might want to put it in writing and refer to it regularly. You could partner with friend or relative who may also have a goal they are trying to reach. They can be your accountability partner and you can rely on each other as you work to accomplish your goals. They can also be someone to celebrate with when you finally reach the goal you worked so hard to achieve!

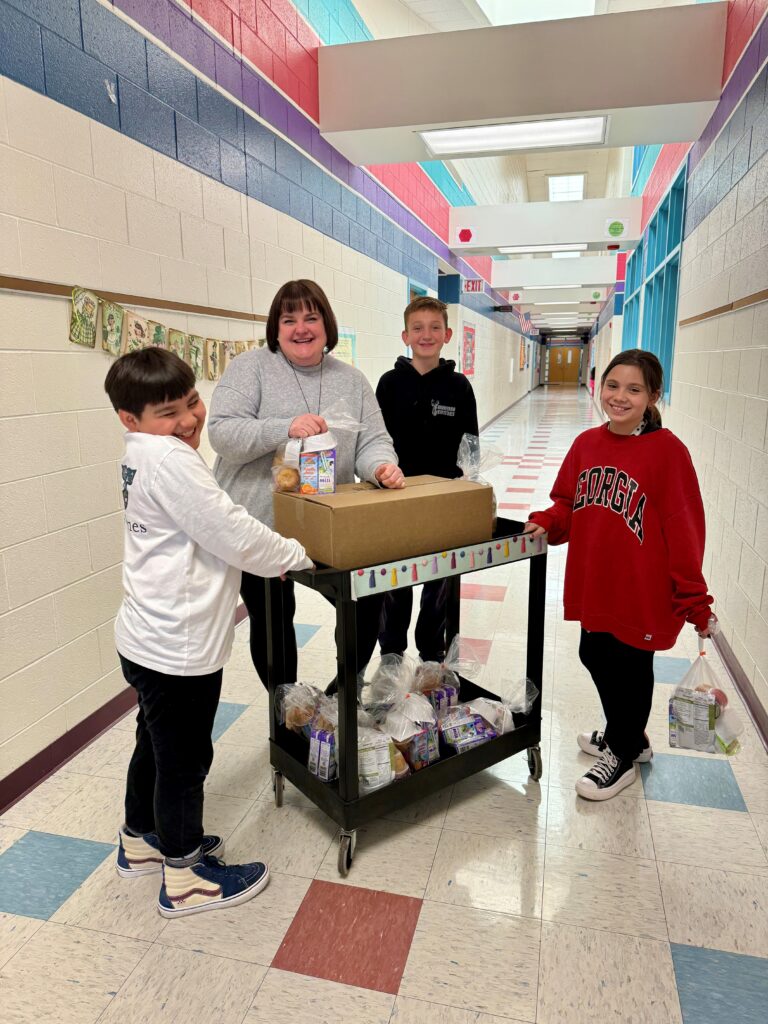

Interested in setting up a time to meet with the Food Bank of Delaware’s $tand By Me Coach? Click here to learn more or contact Allison directly at arussell@fbd.org or (302) 292-1305 ext 206.