Resolutions 2018, Oh My!

February 13, 2018

By Lisa Grinnage, $tand By Me Financial Coach

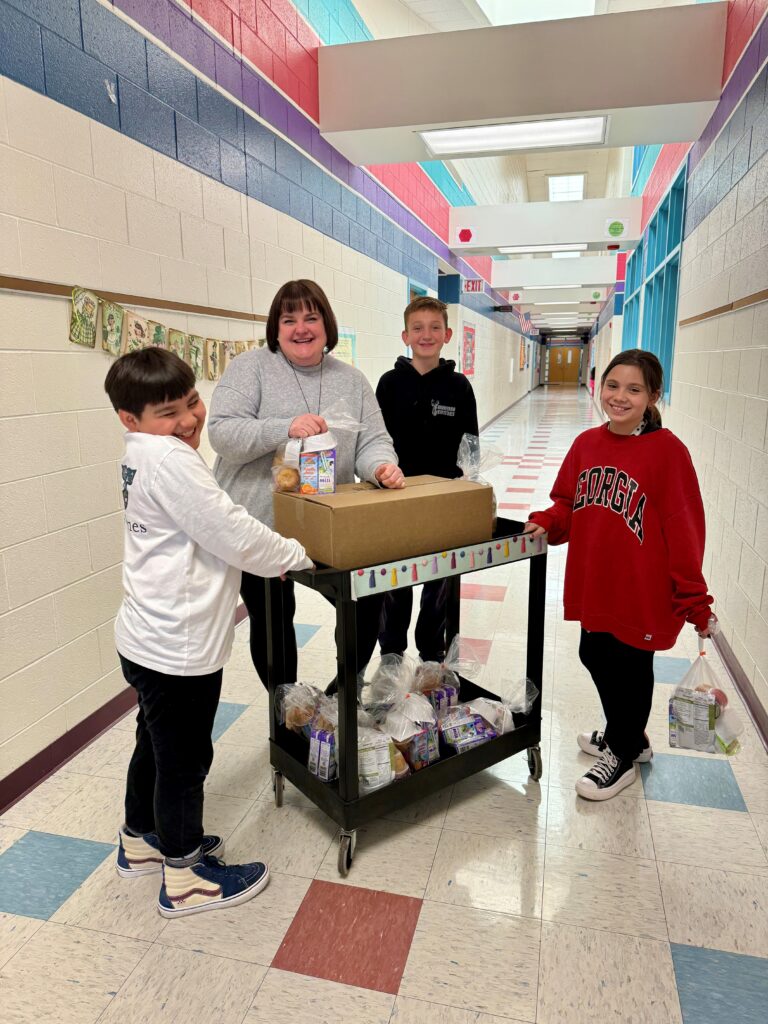

It’s hard to believe, but January is over, and February is halfway through! How are you coming along with your New Year’s Resolutions? Maybe you didn’t set one. It’s never too late to start new habits… especially as they relate to your finances! As one of the $tand By Me financial coaches at the Food Bank of Delaware, I have witness that in 2018 more people are becoming focused on getting out of debt and changing their spending habits. If you are one of those people who are looking to better your financial stability – this conversation is for you.

First things first – create a budget. A budget can help you pay your bills on time, cover unexpected emergencies, and reach your financial goals – now, and in the future. Most of the information you need for your budget is already at your fingertips. Create a budget worksheet. There are many ways in which to do this; electronically, a notepad, or a printed out spreadsheet. No matter which way you choose, the most important part is to start. You are probably asking yourself, “Where I should start?” Well, the first step would be to look at what you spend on a monthly basis. Fill in your income, calculate your flexible expenses (food, entertainment, debt payments, etc.), fill in your fixed expenses (housing, grocery, utilities, transportation, and health). Then you will add up your expenses and subtract them from your income. You will either have a surplus or a deficit. If you have a deficit, you will want to make changes to your flexible expenses first. If you have a surplus, you will take this to begin the building of your emergency savings. An emergency savings is not something for you to use towards buying new furniture, but to use towards covering your monthly expenses if something was to happen to you and you were no longer bringing in any income or if your car breaks down and you need to repair it. I know it seems like this is difficult to do, but with focus and determination you will succeed. Also, if you need any assistance or guidance, you can always reach out to a $tand By Me® Financial Coach. He or she will work with you one-on-one for FREE.

Once you have completed your budget you will want to focus on how to do I get out of debt. Have you checked your credit reports and scores for the year? If not, you really should. There are several ways in which to begin the process of getting out of debt. 1) www.annualcreditreport.com – this will allow you pull all three credit bureaus (Trans Union, Equifax, and Experian) for free. The only thing that it does not provide you with for free is your credit score. 2) www.creditkarma.com – you will sign up with Credit Karma so you can monitor your credit from two credit bureaus (Trans Union and Equifax Only). 3) You can sign up with a $tand By Me® Financial Coach and they will pull all the credit bureaus and provide you with your credit scores. In addition to that, they will review the entire report with you and help you through the process of building or rebuilding your credit and again, it is FREE.

Let’s start the process of taking control of your financial future with free one-on-one financial coaching and remember the key to success in anything is determination! So let’s start and finish this New Year off right. Let’s get financially empowered!!

Contact one of us:

Lisa Grinnage

$tand By Me Financial Coach (New Castle County)

(302) 292-1305 ext 206

lgrinnage@fbd.org

Elisa Lopez De la Cruz (Kent/Sussex Counties)

(302) 424-3301 ext 117

eDeLaCruz@fbd.org